HospitalFinances.org

Bringing transparency to nonprofit hospital finances

Welcome to hospitalfinances.org, a website run by the Association of Health Care Journalists (AHCJ). The purpose of this site is to make nonprofit hospital finances easier to access, search and analyze. You will find details of Form 990 filings made by nonprofit hospitals and systems to the U.S. Internal Revenue Service. It does not include for-profit or government-owned hospitals.

What can health journalists do with the 990s?

- Track CEO salaries. These documents can show the highest paid nonprofit executives in a particular area or state. You can compare salaries among different hospitals and learn if big pay increases were earned by improved finances.

- Check if hospitals have made payments to what the IRS calls “interested persons.” These are the family and business partners of board members, officers and top employees, and those insider payments can drive many stories.

- Learn if anyone got first-class charter travel, companions travel, housing money, a personal residence, health/social club dues, severance payments and more.

- See who serves on the nonprofit board and oversees all the group’s activities. These people are above the top officers yet often lack health care experience. They tend to be big donors.

- Document the “community benefit” nonprofit hospitals provide for their area. Systems are required to give back to the community in return for their tax-free status. But with no set amount required, there is often a wide disparity.

What is a 990?

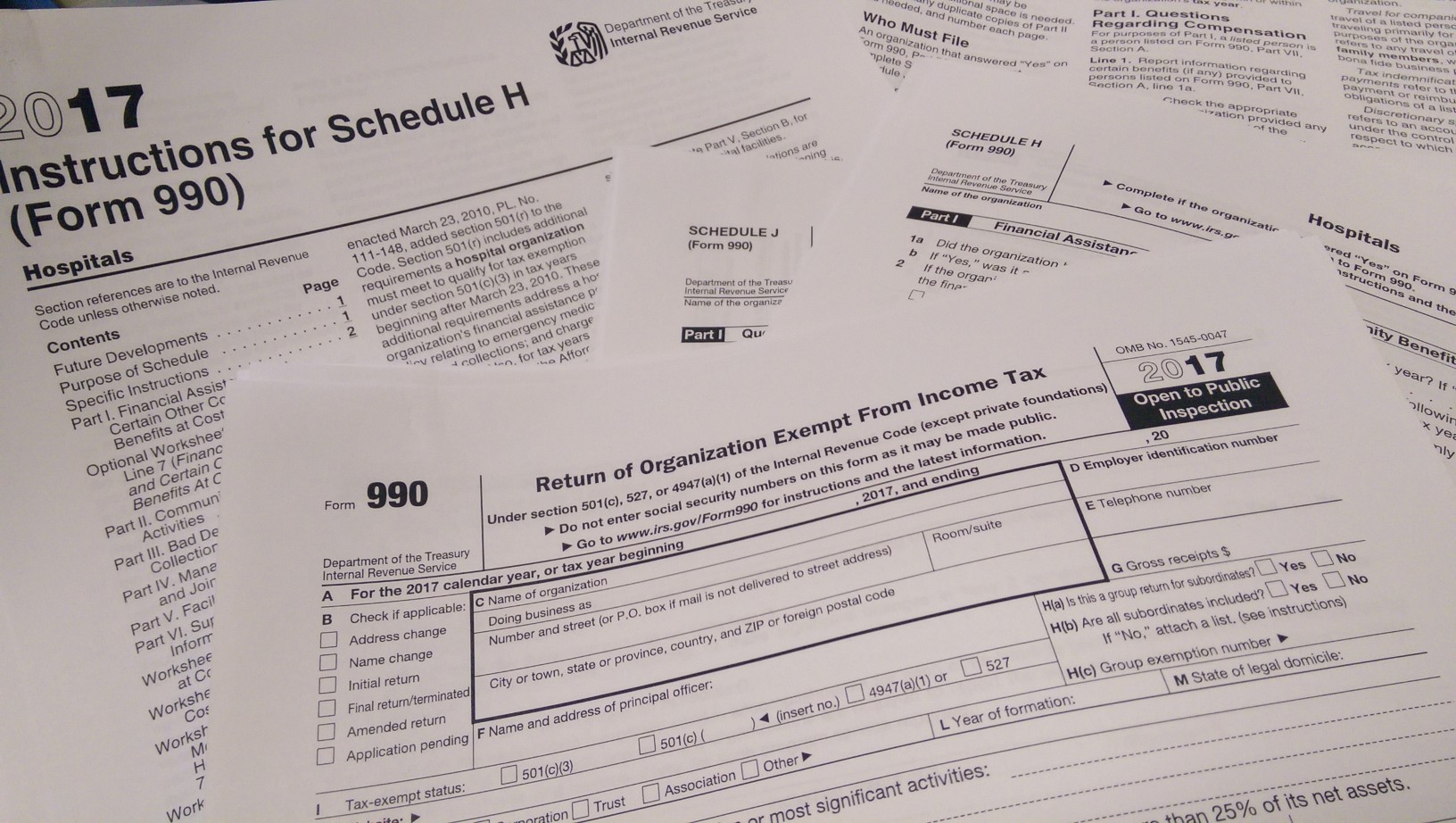

A Form 990 is a tax return for organizations that are almost completely tax exempt. In return for being untaxed, the nonprofit must provide the public with the 990, summarizing the group’s pay, finances and governance practices. Hospitals and systems also must include a Schedule H form with their 990, showing their “community benefit.” Learn more about Schedule H forms here.

The search results focus on key 990 elements. They include basic finances, compensation of top executives, community benefits and other details. The data come from filings that the hospitals send to the IRS. Our presentation does not include a complete copy of the 990, which can be requested from the hospital. (By law, they have to give it to you.) You can also get copies of a 990 from some of the groups under the link “References and resources” on this page.

If you have questions or feedback on this site, email Kevin Ridder at Kevin@healthjournalism.org.

This effort follows years of training by AHCJ to encourage journalists and the public to use 990 filings and learn more about hospitals.

General Sites

- ProPublica’s Nonprofit Explorer

- GuideStar

- IRS Explains Schedule H for hospitals

- Lown Institute Fair Share Spending

- U.S. Senate Health Committee report: Nonprofit Hospitals’ Tax Breaks and CEO Pay

Stories based on 990s

- Big Hospitals Skimp on Charity Care Despite Billions in Tax Breaks (WSJ) (paywalled)

- A Hospital Chain Ignited Its Own Staffing Snafu (NYT) (paywalled)

- They Were Entitled to Free Care. Hospitals Hounded Them to Pay (NYT) (paywalled)

- Hospitals Often Don’t Help Needy Patients, Even if They Qualify (WSJ) (paywalled)

- Value of Tax Exemption for Nonprofit Hospitals Was $28b in 2020 (KFF)

- Report: CT hospitals could give more to charity. (Hartford Courant)

- Local hospital execs got millions in bonuses during pandemic (Dayton Daily News)

- What Arizona hospital CEOs made during COVID (Azcentral.com) (paywalled)